Imagine a pilot trying to fly an aeroplane without a dashboard. If you were the pilot, would you feel secure, and in control of your destiny?

Of course, running a business is vastly different to flying an aeroplane. However, the core principle remains the same, in that access to essential information is key to a successful journey. Conversely, not having have access to this information can result in you making uninformed decisions at critical moments. Whether navigating a plane or managing a business, the result is likely to be catastrophic.

The state of financial visibility for Australian SMEs

If you don’t feel like you truly have visibility over your business finances, you are not alone.

Alarmingly, according to market research conducted by Empiraa in 2023, only 26% of all business owners surveyed were happy with the level of visibility they had over their business.

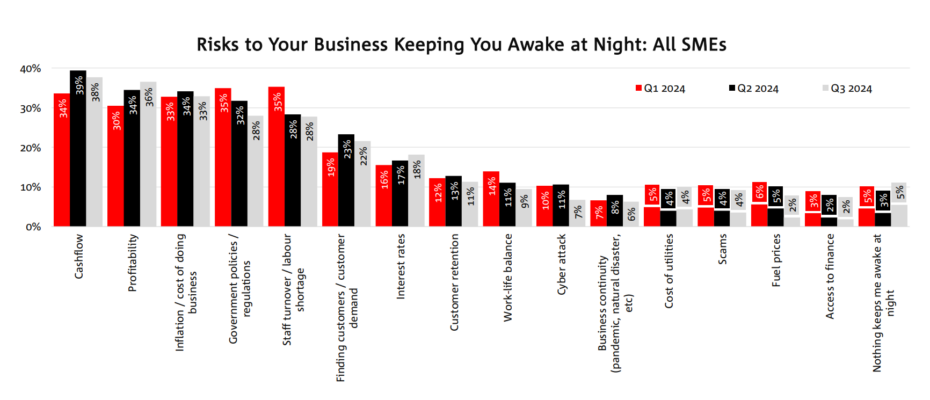

Exacerbating this finding are the results of a survey conducted by NAB, entitled “What’s keeping SME business owners and managers awake at night?”. Results show that Australian business confidence is continuing a downward spiral, and lists cashflow, profitability and the cost of doing business as key concerns for SME business owners.

These three concerns are all key reporting items that every business needs to gain a clear financial picture of how their business is performing.

Figure 1: Source – NAB Q3 2024 ‘What’s keeping SME business owners and managers awake at night?”

Why visibility of the full financial picture matters

Managing a small to medium-sized business in Australia is extremely challenging and it is essential to keep a finger on the pulse of cashflow, profitability and costs. Businesses should be setting goals and measuring performance, whether they are in the start-up or growth phases.

Visibility is not just about understanding the current state of business. It includes the ability to estimate future performance, a brand’s presence in the market, and a customer’s experience with a particular company. Business leaders need access to this data to effectively run the business.

Some of the greatest minds in business support the use data-driven KPIs and OKRs (Objectives and Key Results) to drive business performance. OKRs is a simple methodology for goal setting where each business objective outlines a desired outcome and is supported by quantifiable and measurable results.

Key performance areas need to be measured so that corrective action can be taken if required. Visibility of the full financial picture can therefore help mitigate key risks in the business, improve decision making and ultimately, manage stress levels of business owners and management. This will give your business the best chance of survival.

If you are one of the 74% of business leaders unsatisfied with the level of visibility and reporting, the good news is that there is a way forward. And it need not break the bank either.

Your financial co-pilot: the strategic role of an outsourced CFO

For many business leaders, the key to making informed decisions lies in having a 360° view of their company’s goals, often expressed in financial terms. This holistic view provides insights into key performance metrics, allowing leaders to see the big picture as well as the finer details.

One way to improve your view of the future, is to implement budget tracking and produce a 3-way forecast, to link action plans to measurable results, and to track performance.

A qualified, experienced financial controller or CFO can set this up for you. However, the stark reality is that many businesses lack the in-house financial expertise and cannot afford the services of a full-time (FTE) resource, which is often perceived as being too expensive.

The good news is that you do not have to hire an FTE. Partnering with an established and respected outsourced CFO can help your business reach its full financial potential at a fraction of the cost.

Having the ability to sit down with a seasoned CFO and have a meaningful conversation about the state of your business can help you mitigate the grave risk of piloting without a dashboard, improving the odds of your business succeeding.

Take your financials to the next level today with an expert CFO or financial controller. Talk to our team to learn more.